Naked Wealth Blog

With the holiday period around the corner, we hope you get a chance to slow down and take some time out for yourself. With that being the case, you may just start thinking about your money and finances and that can become a dangerous thing! So take this as us reminding you that keeping your financia...

Last week we gave you what we hope were some valuable tips to help ensure your retirement savings can go the extra mile.

This week we want you to stop and think about how much money you would need to make getting up for work every day a choice? What if you didn’t turn up to work tomorrow, how long ...

Here’s you… super is boring, who cares, its tomorrow’s problem, I don’t really understand it anyway…

Here’s us… you’re being super silly! If superannuation were a country, many of us would try moving there simply due to the generous tax savings on offer. Tax savings now, and tax savings later too!

If we could have one wish for all our members, it would be to ensure you all build and maintain the foundations of your financial house.

Why?

Because by having a financial house with strong foundations you’re almost certain to “get ahead” financially regardless of what unforeseen events unfold. Yo...

It’s almost June and we’re on the home straight to the finish line for this financial year.

So this is our gentle nudge for some of you who might wish to consider making a contribution to your super fund, perhaps save some tax too!

Here’s the deal… hopefully you’re already well aware that super is...

When it comes to being a financial winner, slow and steady really does win the race! Small step after small step will help you achieve big results. In our minds, this is the only pathway that will ensure you succeed financially.

It seems a lifetime ago we started banging on about the importance for...

Chewing the financial fat, day after day, with many hard-working Australians has helped us to identify common mistakes. Common money mistakes that too many people make and pay for overtime. We’re sharing them with you in the hope that you can avoid as many of them as possible!

1. No Set Goals

You ar...

Welcome back to your weekly three-minute dose of money wisdom. We hope you’ve enjoyed a nice break and you’re ready to be that little bit more awesome with your money in 2025.

We hear a lot about goals, goals and more goals at this time of year. Truth be told, we like financial goals but they are f...

We thought to share something a little different for this week’s money in minutes.

Introducing Die With Zero, a book written by Bill Perkins, which for us, as money nerds, was a much more interesting read than most finance books. We feel it has a lot of good to offer our members (and of course some...

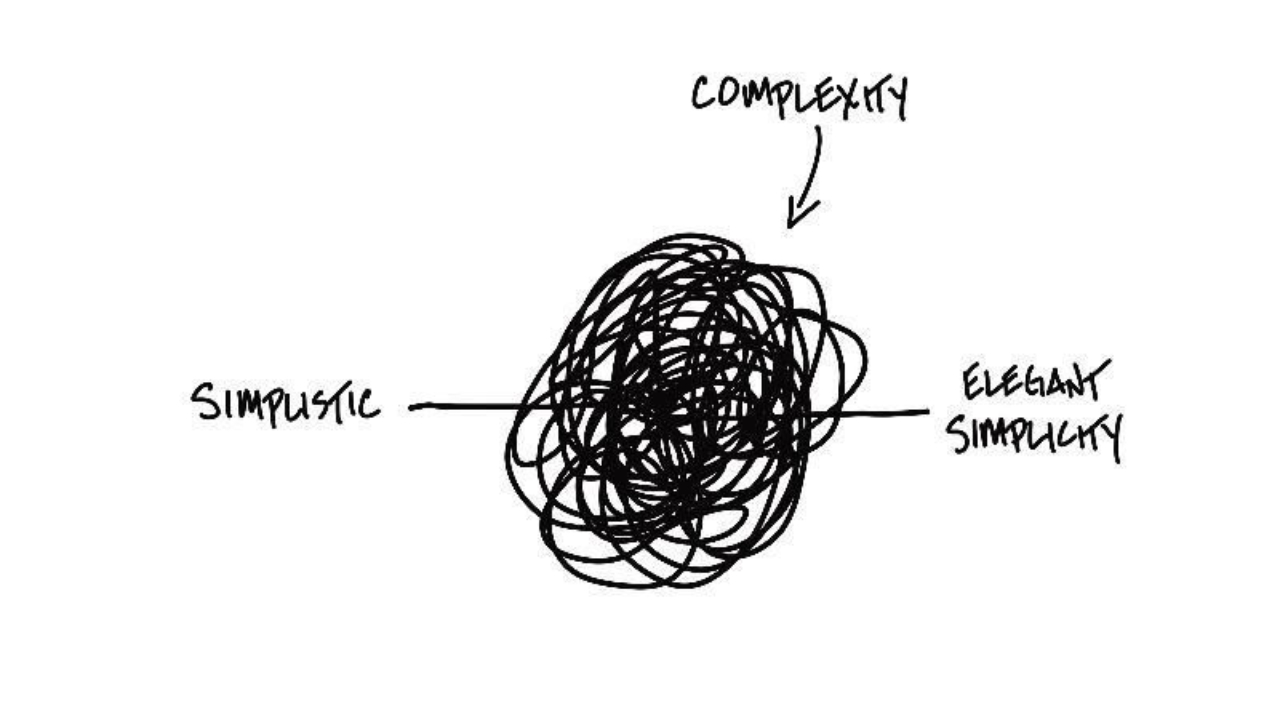

If you’ve followed us for long enough, you’ll have heard us talk about the importance for members to take small steps that over time lead to massive gains, focusing on what you can control and what matters, using minimal effort to get maximum results, and of course ensure you plan ahead. These are k...

If you had $10 million you could probably have money fights with yourself, buy lots of unnecessary stuff, help charities in need, and still have plenty of money to be financially secure AND most importantly, hang up your work boots!

So, if you had $10 million you can safely assume you’ve run and ...

There are plenty of financial advisers who are only looking to advise people who have lots of money and then charge them high fees to manage that money for them. That’s a little at odds with most of the population who aren’t “rich”.

Fortunately, there are other financial advisers whose mission is t...